Get Business And Personal Loan With Navi App | Earn Upto ₹100 Cashback By Investing in Digital Gold

GET INSTANT PERSONAL AND BUSINESS LOAN WITH NAVI

अगर ये लिंक ओपन नहीं होता है तो इस लिंक 👇https://g.navi.com/1VLYP5 को कॉपी करके क्रॉम ब्राउजर में पेस्ट करें

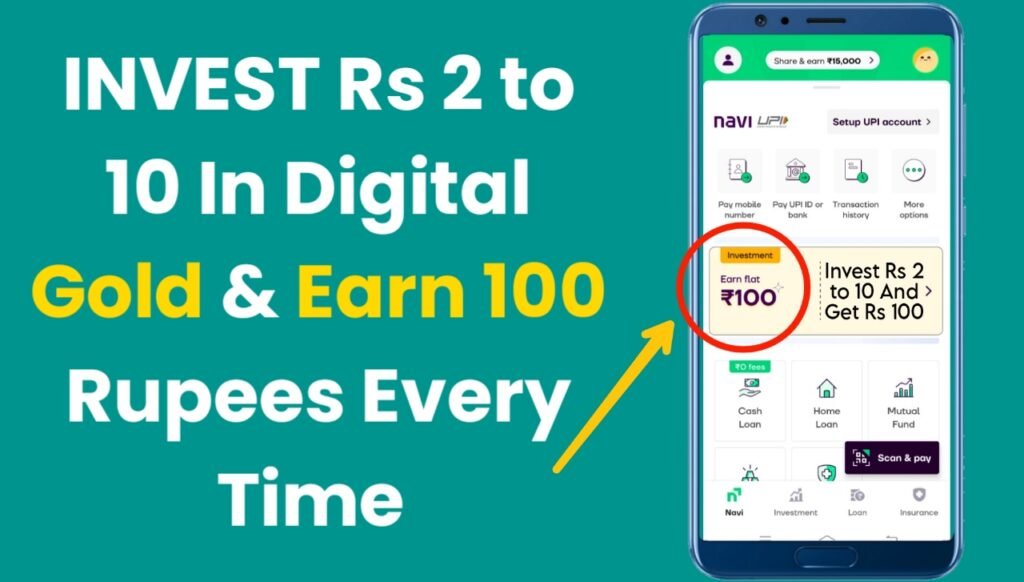

EARN MONEY WITH NAVI APP Rs 100 RUPEES CASHBACK

What Is Navi Personal Loan?

Navi is A Personal Loan App Where you can Get Personal loan to meet any financial requirement, be it for paying your credit card bills or funding your wedding. These loans are unsecured loans, meaning you don’t have to pledge collateral or a guarantor to get the loan. Like any other loan, you are required to repay the borrowed amount in EMIs.

Navi offers instant personal loans with minimal documentation in a 100% paperless manner. Download the Navi app from Play Store or App Store, apply and get your preferred loan amount disbursed to your account within minutes.

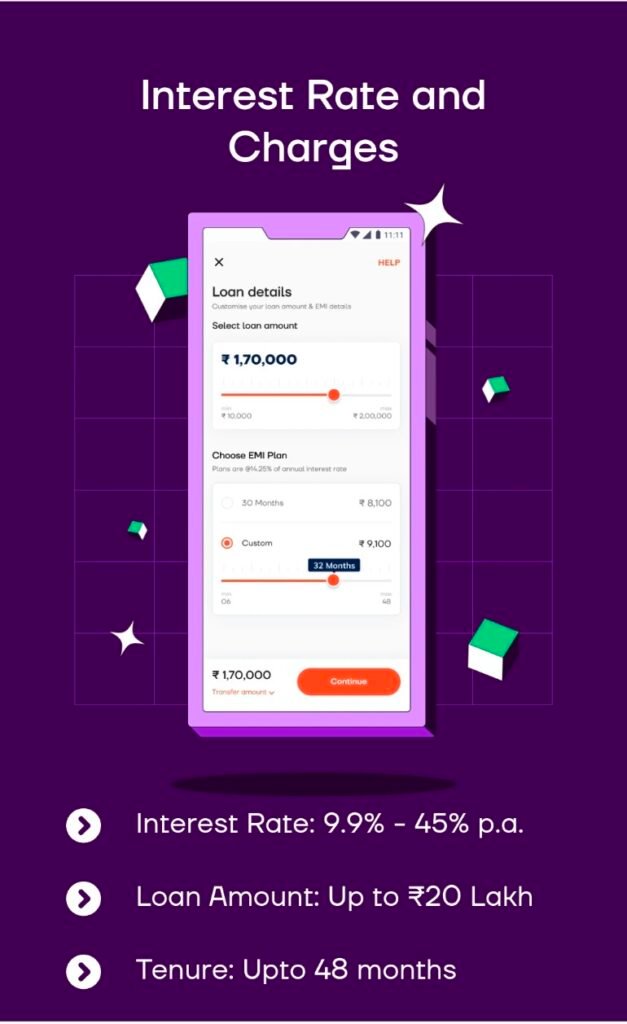

Flexible EMI Option

Get your loan and repay it in easy EMIs at your convenience. Navi offer flexible repayment tenures of up to 6 years or 48 months.

What is Business Loan?

Business Loans are funds available to all types of businesses from banks, non-banking financial companies (NBFCs), or other financial institutions. Business Loans can be tailor-made to meet the specific needs of growing small and large businesses. These loans offer your business the opportunity to scale up and give it the cutting-edge necessary for success in today’s competitive world.

Business Loans for the micro-small-medium enterprise (MSME) sector in India are particularly important as MSMEs are important economic drivers of growth, and job creation, which directly impacts local economies. Lack of access to formal finance, the requirement of property collateral for loans, and the lack of affordability for modern technology solutions are some of the impediments hampering the growth of the MSME sector.

How much can I borrow for a business loan?

The amount you can borrow for a business loan may depend on your business’s financial situation, credit score, collateral, revenue and other financial metrics. Lenders typically offer loans from a few thousand dollars to several million dollars, with repayment terms ranging from a few months to several years.

See our Business calculators which may assist you in determining how much you can afford to borrow, help you manage your cash flow and run your business.

How To Apply For A Business Loan?

To apply for a business loan, you will typically need to provide the lender with information about your business. This may include your financial statements, tax returns, bank statements, business plan and other relevant documents.

You may also be required to provide collateral or a personal guarantee. Find out more here Small business loans – what to know before applying or speak to a NAB Business Banker to have a solution tailored to you.

How to Start Dropshipping Business: High Paying Work From Home Job

High-Paying Jewelry Packing Work-from-Home Jobs 2024

Graphic Designer Work from Home: A Modern Career Path

Top 10 High Paying Work From Home Jobs in India for 2024

Govt Loan Scheme: क्या आपको पता है की सरकार गर्भवती महिलाओं को ₹11000 दे रही है

PMEGP LOAN: सरकार की ये योजना बनाएगी लखपति जाने आवेदन कैसे करें

PERSONAL LOAN: मोबाइल से सरकार का ये कार्ड बना लो मिलेंगे ₹5 लाख।

Aadhar Card Se Loan Kaise Le: ये 5 ऐप दे रहे आधार कार्ड पर लोन | Get Personal Loan Upto 15 Lakh

PM HOME LOAN SUBSIDY YOJNA: सरकार से घर बनाने के लिए मिलेगा ₹50 लाख का लोन भारी सब्सिडी पर

PM HOME LOAN: आवास योजना को लेकर बजट में हुआ ऐलान मिलेंगे ₹2.50 लाख । लिस्ट चेक करे

BUSINESS LOAN APPLY: सरकार देगी इस कार्ड से ₹3 हजार हर महीने और ₹2 लाख अलग से

INSTANT LOAN: सरकार इस नई योजना से महिलाओं को दे रही ₹1250 हर महीने

PERSONAL LOAN: मोबाइल से सरकार का ये कार्ड बना लो मिलेंगे ₹5 लाख।

Aadhar Card Se Loan Kaise Le: ये 5 ऐप दे रहे आधार कार्ड पर लोन | Get Personal Loan Upto 15 Lakh

PM HOME LOAN SUBSIDY YOJNA: सरकार से घर बनाने के लिए मिलेगा ₹50 लाख का लोन भारी सब्सिडी पर

PM HOME LOAN: आवास योजना को लेकर बजट में हुआ ऐलान मिलेंगे ₹2.50 लाख । लिस्ट चेक करे

BUSINESS LOAN APPLY: सरकार देगी इस कार्ड से ₹3 हजार हर महीने और ₹2 लाख अलग से

INSTANT LOAN: सरकार इस नई योजना से महिलाओं को दे रही ₹1250 हर महीने

PERSONAL LOAN: मोबाइल से सरकार का ये कार्ड बना लो मिलेंगे ₹5 लाख।

Aadhar Card Se Loan Kaise Le: ये 5 ऐप दे रहे आधार कार्ड पर लोन | Get Personal Loan Upto 15 Lakh

PM HOME LOAN SUBSIDY YOJNA: सरकार से घर बनाने के लिए मिलेगा ₹50 लाख का लोन भारी सब्सिडी पर

PM HOME LOAN: आवास योजना को लेकर बजट में हुआ ऐलान मिलेंगे ₹2.50 लाख । लिस्ट चेक करे

BUSINESS LOAN APPLY: सरकार देगी इस कार्ड से ₹3 हजार हर महीने और ₹2 लाख अलग से